Indonesia Oil & Gas Market Segment Share by Service: Construction Segment Holds the Largest Share Driven by Infrastructure Expansion

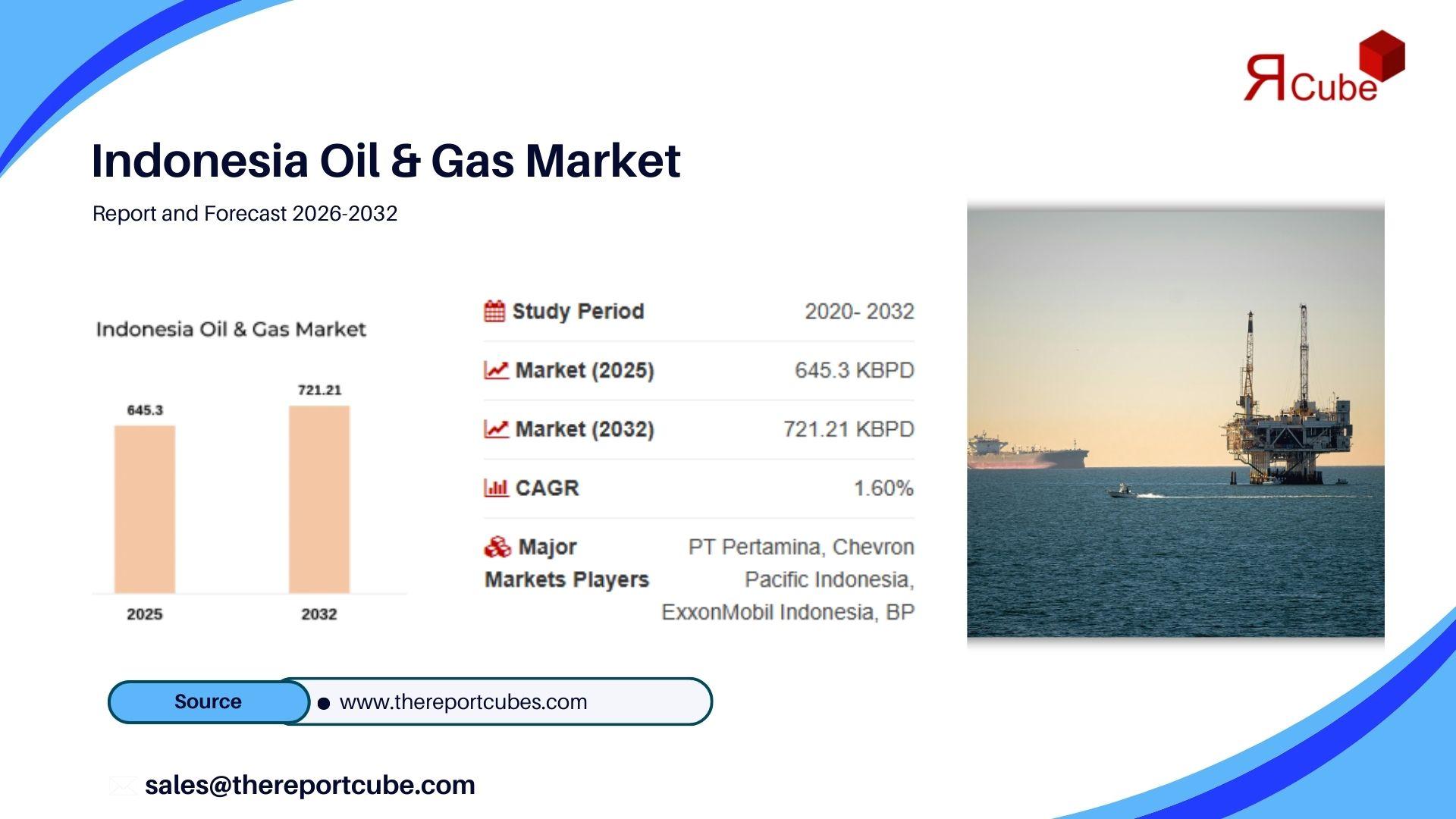

The Indonesia Oil & Gas Market is projected to grow at a compound annual growth rate (CAGR) of around 1.60% between 2026 and 2032, reflecting the country’s sustained focus on energy security, infrastructure expansion, and upstream revitalization. Valued at approximately 645.3 thousand barrels per day in 2025, the market is expected to reach nearly 721.21 thousand barrels per day by 2032, reinforcing Indonesia’s role as a key energy player in Southeast Asia.

Indonesia’s oil and gas industry spans upstream exploration, midstream transportation, and downstream refining and distribution. The government, through SKK Migas, continues to promote foreign and domestic investment by enhancing Production Sharing Contract (PSC) schemes, accelerating licensing approvals, and offering improved fiscal incentives. These reforms are aimed at countering declining production from mature fields while encouraging exploration in frontier and offshore regions.

Recent developments underscore the sector’s forward momentum. In 2025, PT Pertamina commenced operations at the upgraded Balikpapan Refinery, increasing national refining capacity and enabling cleaner fuel production aligned with energy transition goals. In the upstream segment, a major offshore gas discovery at the Geng North-1 well in East Kalimantan has strengthened confidence in Indonesia’s deepwater potential, with reserves estimated at over one trillion cubic feet of gas.

For an overview before purchase, request your Free Sample of the research report and evaluate how this study aligns with your strategic objectives.

https://www.thereportcubes.com/request-sample/indonesia-oil-and-gas-market

Market Drivers and Challenges

Rising domestic energy demand remains the primary growth driver. Rapid urbanization, industrial expansion, and increased transportation needs are pushing oil and gas consumption higher. To address this, Indonesia is investing heavily in gas pipelines, LNG regasification terminals, and gas-fired power infrastructure, positioning natural gas as a transitional fuel in its long-term energy strategy.

However, the industry faces challenges from declining output at aging oil fields in Sumatra and Java. Without large-scale enhanced oil recovery (EOR) investments and new discoveries, Indonesia risks deeper reliance on imports. Addressing this challenge is critical to maintaining energy independence and stabilizing long-term market growth.

Opportunities and Emerging Trends

Indonesia’s vast maritime geography offers significant opportunities in offshore and deepwater exploration, particularly in underexplored eastern regions. Advances in seismic imaging and drilling technologies, combined with supportive government policies, are expected to unlock new reserves and improve production efficiency.

A key trend shaping the market is Indonesia’s gradual shift from oil to gas. The government’s net-zero emissions target for 2060 has accelerated gasification initiatives, including LNG expansion, city gas networks, and the conversion of coal-based facilities to gas. Industry players are also adopting digital oilfield technologies and sustainable exploration practices to reduce costs and environmental impact.

Segment and Regional Outlook

The upstream sector continues to dominate the Indonesia Oil & Gas Market due to ongoing exploration activity and investment in new blocks, particularly in Kalimantan and offshore Sumatra. By service, construction leads the market, supported by large-scale infrastructure development across midstream and downstream segments.

Regionally, Kalimantan remains the most attractive investment destination, driven by abundant reserves, active offshore projects, and planned LNG and logistics infrastructure. The region is expected to retain its leadership position through 2032.

Outlook

With supportive government policies, rising gas demand, and strategic investments across the value chain, the Indonesia Oil & Gas Market outlook remains positive. As the country balances economic growth with energy transition goals, oil and gas will continue to play a central role in national development over the coming decade.

To explore detailed insights, in-depth data tables, and full forecast analysis, readers can View Full Research Report published by Report Cube.

https://www.thereportcubes.com/report-store/indonesia-oil-and-gas-market

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness