How Can an Offshore CPA Help Your Business Scale Faster?

Offshore CPA support gives businesses access to skilled professionals, secure systems, and flexible accounting solutions for long-term growth.Growing companies are choosing offshore CPA solutions to streamline accounting, reduce overhead, and gain expert financial insights.

As businesses grow, managing finances becomes more complex. Payroll expands, compliance becomes stricter, reporting requirements increase, and strategic tax planning becomes critical. At this stage, many companies start looking for smarter, more scalable financial support — and that’s where an offshore CPA comes into the picture.

But why are more growing companies trusting offshore accounting professionals? Is it only about cost savings, or is there more value behind the decision?

Let’s explore this in a simple, practical, and business-focused way.

What Does an Offshore CPA Do?

An offshore CPA is a certified accounting professional who provides accounting, financial reporting, tax support, and compliance services while working remotely from another country. These professionals often work as an extension of your internal team.

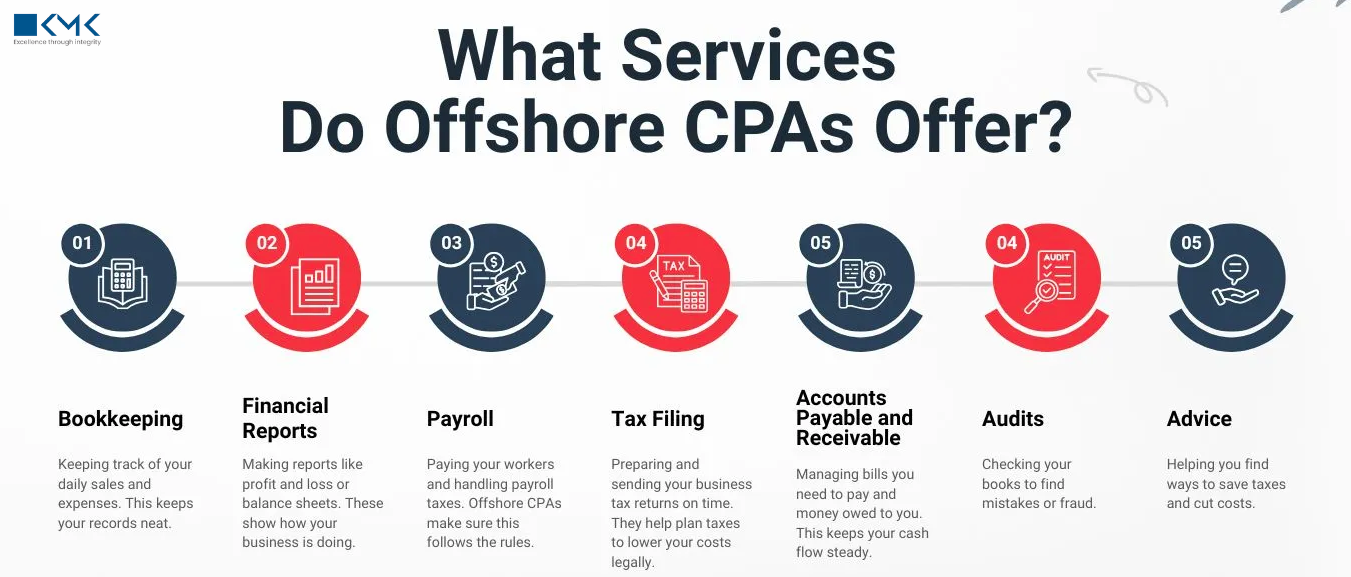

They typically support areas such as:

-

Financial statement preparation

-

Tax planning and compliance

-

Accounts payable and receivable management

-

Payroll support

-

Internal audits and reconciliations

-

Regulatory reporting

This allows companies to maintain strong financial discipline without expanding their in-house accounting department.

Why Are Growing Companies Choosing Offshore CPAs?

Growth brings pressure. Systems that worked when a company was small often break down when transaction volumes increase. Here are the real reasons companies shift to an offshore CPA model.

1. Cost Efficiency Without Compromising Expertise

Hiring a full-time, local CPA can be expensive. When you factor in salary, infrastructure, training, and compliance costs, the overall expense grows quickly. Offshore CPAs provide access to the same level of professional expertise at a significantly lower cost.

Ask yourself: Would your business benefit from senior-level expertise without senior-level costs?

2. Access to Specialized Financial Knowledge

Offshore CPAs often work across international markets, industries, and accounting frameworks. They bring experience in:

-

International tax structures

-

Multi-country compliance

-

Industry-specific regulations

-

Advanced financial reporting standards

This makes them valuable partners for companies planning expansion or managing cross-border operations.

3. Faster Turnarounds and Better Workflows

Different time zones can be a business advantage. Offshore CPAs can complete reconciliations, prepare reports, and review data while your internal team is offline. This creates a near 24-hour financial workflow.

By the time your workday starts, reports are already ready — which improves operational speed and reduces bottlenecks.

How Offshore CPAs Improve Day-to-Day Business Operations

An offshore CPA doesn’t just “handle numbers.” They improve how finance supports your entire business.

1. Real-Time Financial Visibility

Up-to-date dashboards, balance sheets, and profit and loss statements help leaders make faster decisions. With consistent monitoring, you gain better visibility into:

-

Cash flow trends

-

Outstanding receivables

-

Vendor liabilities

-

Expense patterns

2. Improved Compliance and Risk Management

Compliance mistakes can be costly. Offshore CPAs apply structured processes, internal controls, and document management systems to ensure your records remain audit-ready at all times.

What Types of Businesses Benefit Most from Offshore CPAs?

While almost any company can benefit, offshore CPA services are especially valuable for:

-

Startups preparing for funding rounds

-

E-commerce businesses handling large transaction volumes

-

SaaS companies managing subscription revenue

-

Real estate and property management firms

-

Service-based companies with recurring billing

For these growing businesses, having a reliable, remote financial expert can make a measurable difference.

Is an Offshore CPA Right for Your Business?

Ask yourself these practical questions:

-

Are financial reports delayed or inconsistent?

-

Is your accounting team overloaded?

-

Do you need strategic tax or financial planning support?

-

Are you planning to scale or expand to new markets?

If the answer is “yes,” working with an offshore CPA can be a smart, future-focused move.

Final Thoughts

Choosing an offshore CPA is no longer just about saving money. It’s about gaining access to global expertise, improving financial accuracy, and building scalable financial systems that support long-term growth.

For growing companies, this approach provides flexibility, reliability, and strategic insight — everything needed to handle financial complexity with confidence.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness