Core Banking Software Market Witnesses Surge in Demand for Real-Time Processing 2030

Core Banking Software Market: Empowering the Digital Banking Revolution

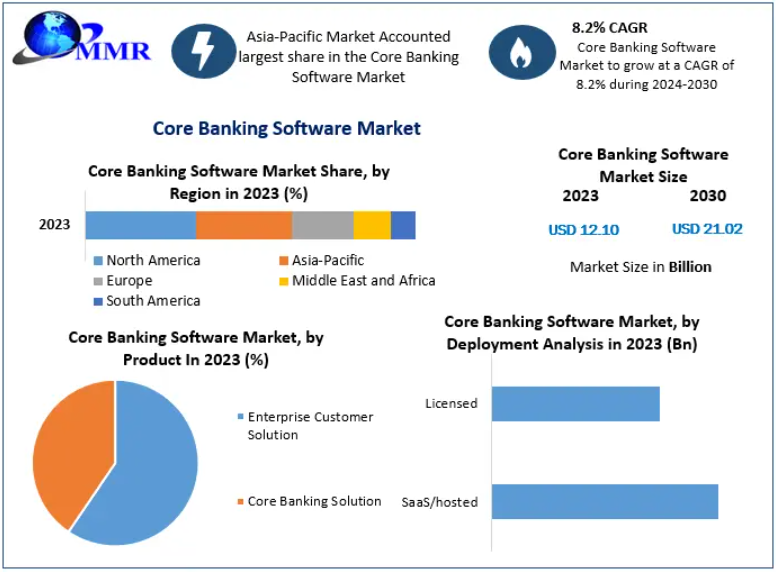

The global Core Banking Software Market, valued at US$ 12.10 billion in 2023, is on track to reach US$ 21.02 billion by 2030, growing at a CAGR of 8.2%. As banks shift toward high-speed digital operations and customer-centric service models, core banking software (CBS) has emerged as the digital backbone of modern financial institutions.

Core Banking Software Overview

Core banking software acts as a centralized system that allows financial institutions to manage transactions across all their branches from a single platform. By eliminating branch-specific silos, CBS provides:

- Real-time transaction processing

- Omni-channel access for customers (online, mobile, branch)

- Integrated customer data management

- Automation of front-end & back-end workflows

- Enhanced security & compliance

The shift toward digital banking—driven by millennials and Gen Z, rising mobile banking penetration, and cloud adoption—has accelerated the importance of CBS for banks globally.

To know the most attractive segments, click here for a free sample of the report: https://www.maximizemarketresearch.com/request-sample/148072/

Market Dynamics

✔ Key Growth Drivers

1. Surge in Demand for Digital Banking

Consumers increasingly demand seamless, 24/7 digital access to banking services. Core banking technology enables banks to integrate mobile banking, APIs, and real-time customer service capabilities.

2. Cloud Adoption Reshaping Bank Operations

Cloud-based CBS offers scalability, lower capital expenditure, and faster deployment. Banks adopt cloud to simplify:

- Payment processing

- Loan management

- Data storage and analytics

Notably, Temenos AG’s launch in January 2022 of a cloud-native banking platform strengthened the shift toward cloud-centered digital banking.

3. Integration of AI, Big Data & Analytics

AI-driven CBS enables banks to:

- Detect fraud in real time

- Personalize customer experiences

- Predict consumer behavior

- Streamline underwriting and credit evaluation

The industry is moving toward smart, predictive, and automated banking systems.

✖ Market Restraints

Despite strong growth, some challenges persist:

1. Low Awareness Among Smaller Institutions

Many small banks lack clarity on the ROI and implementation benefits of CBS, slowing adoption rates.

2. Security & Data Privacy Concerns

Cloud-based deployments bring risks involving:

- Data breaches

- Unencrypted data

- Malware

- Regulatory compliance challenges

These concerns remain major obstacles, especially for banks in emerging economies.

Segment Analysis

1. By Solution Type

• Enterprise Customer Solutions – Dominant Segment (47% share)

These solutions integrate with CRM and ERP systems, helping banks streamline customer management, automate reporting, and strengthen cross-selling capabilities.

• Core Banking Solutions

Enable centralized loan management, deposits, withdrawals, account opening, and transaction monitoring. These systems support the end-to-end customer journey and form the heart of digital transformation.

2. By Deployment

• SaaS/Hosted – Largest Segment

Cloud-based CBS is expanding rapidly due to its low installation cost, scalability, and efficient data handling.

• Licensed Solutions

Expected to grow significantly as banks prioritize high security, on-premise control, and reduced operational risk.

To know the most attractive segments, click here for a free sample of the report: https://www.maximizemarketresearch.com/request-sample/148072/

Regional Insights

North America – Market Leader (29% share)

The region benefits from early digital adoption, strong IT infrastructure, and major players such as FIS, Fiserv, and Jack Henry. SMB banks are increasingly adopting CBS to streamline operations and enhance customer experiences.

Asia-Pacific – Fastest Growing Market

APAC’s growth is fueled by:

- Rising mobile banking adoption

- Rapid digitalization of banks

- Expanding fintech ecosystem

- Large unbanked population opening new opportunities

Countries like India and China are witnessing accelerated CBS adoption as banks modernize outdated legacy systems.

Europe – Strong Technological Adoption

GDPR compliance and demand for digital trust are driving the adoption of secure, data-centric CBS platforms.

Competitive Landscape

The market is dominated by global tech and fintech giants focusing on digital transformation, cloud banking, and AI-driven analytics.

Key Players:

- Capgemini

- Finastra

- FIS

- Fiserv, Inc.

- Infosys Limited

- Jack Henry & Associates

- Oracle Corporation

- Temenos Group

- Unisys

- TCS

- Mambu GmbH

- nCino

- Backbase

- Forbis

- Wipro Core Banking Services

- C-Edge Technologies

Players are investing in:

- cloud-native CBS

- real-time decisioning tools

- cyber-security enhancements

- API-driven banking ecosystems

Future Outlook

The future of the core banking software market is shaped by:

- AI-powered predictive banking

- API-led open banking ecosystems

- Cloud-native banking-as-a-service platforms (BaaS)

- Blockchain-driven security enhancements

- Hyper-personalized customer journeys

As banks worldwide digitize their core operations, CBS will remain the engine powering financial innovation.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness