India Perimeter Intrusion Detection Prevention Industry Growth, Trends | 2034

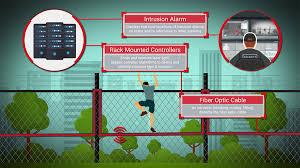

The distribution of growth within the rapidly expanding India Perimeter Intrusion Detection and Prevention (PIDS) market is a clear indicator of the nation's security priorities, with market share increasingly flowing towards vendors that offer reliable, technologically advanced, and integrated solutions. The market's overall expansion is being propelled by massive government and private sector investment in critical infrastructure, including airports, power plants, data centers, and military bases, all of which require sophisticated, multi-layered security. A detailed analysis of the India Perimeter Intrusion Detection Prevention Market Growth Share by Company indicates that growth is not being shared equally among all participants. Instead, it is being disproportionately captured by companies that can offer a complete, end-to-end solution that combines multiple sensor technologies with intelligent video verification and a powerful command-and-control software platform. These high-growth players are successfully capturing share by moving beyond the sale of simple, standalone sensors to provide a holistic solution that reduces nuisance alarms and provides security operators with actionable intelligence.

Several key factors are determining which companies are succeeding in the race for market share growth. The most significant driver is the ability to provide a solution with a very low Nuisance Alarm Rate (NAR). In the challenging Indian environmental conditions, which can include heavy monsoon rains, high winds, and a wide variety of animal life, traditional sensors are prone to false alarms. Companies that have invested heavily in advanced signal processing and, increasingly, AI-based algorithms to differentiate between genuine threats and environmental disturbances are gaining a massive competitive advantage. Another critical growth engine is the tight integration of PIDS sensors with video surveillance systems. The ability to automatically slew a PTZ (pan-tilt-zoom) camera to the exact point of an alarm and to use video analytics to classify the threat (e.g., human vs. animal) is no longer a feature but a necessity. Vendors who can offer this seamless sensor-to-video integration are winning larger and more complex projects.

Looking ahead, the battle for future market share growth will be increasingly fought on the frontiers of artificial intelligence and unmanned systems. The ability to use AI not just for alarm verification but for predictive threat assessment—for example, by analyzing patterns of activity around a perimeter to identify suspicious behavior before an intrusion occurs—is becoming the next major competitive battleground. Furthermore, growth will be captured by providers who can successfully integrate their ground-based PIDS with aerial surveillance platforms, particularly drones. The use of autonomous drones that can be automatically dispatched to an alarm location to provide a real-time aerial view of the situation is a game-changer for large, complex perimeters. The India Perimeter Intrusion Detection and Prevention Market size is projected to grow USD 1.2 Billion by 2034, exhibiting a CAGR of 11.26% during the forecast period 2025-2034. The companies that can master these advanced, AI-driven, and multi-layered solutions will be the ones to lead the market's next phase of significant growth, securing India's most critical assets.

Top Trending Reports -

Italy Centralised Workstations Market

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness